Last Updated on December 15, 2020 by

During this time we see customers utilizing PayPal in different manners. That raises a progression of inquiries encompassing how to add PayPal QuickBooks Online. QuickBooks Online is working to engage masters like you.

QuickBooks Online unites adaptable apparatuses and assets that let you develop and prevail by working more astute, not longer. But this time you can add your PayPal account in QuickBooks. So in this blog, we are talking about the how to add a Paypal account in QuickBooks Online

How to Set Up Connect to PayPal

- Login to QuickBooks Online as an admin user.

- Go to the left menu, click on Apps.

- Choose Connect to PayPal.

- Click on the Get app now.

- Check the box for the required file, then click on Install.

- Hit on the Let’s do it.

- To permit Intuit in order to get data from the PayPal account, click on Give permission.

- Type your email ID linked with your PayPal account then, select Next.

- In case you do not have an account, you will be asked to create a new one.

- In case you create a new account, you have to go back to QuickBooks Online and begin the connection process.

- Log in to your PayPal account.

- To permit the sync, choose Agree and Connect.

- When the connection is established, choose Return to Intuit.

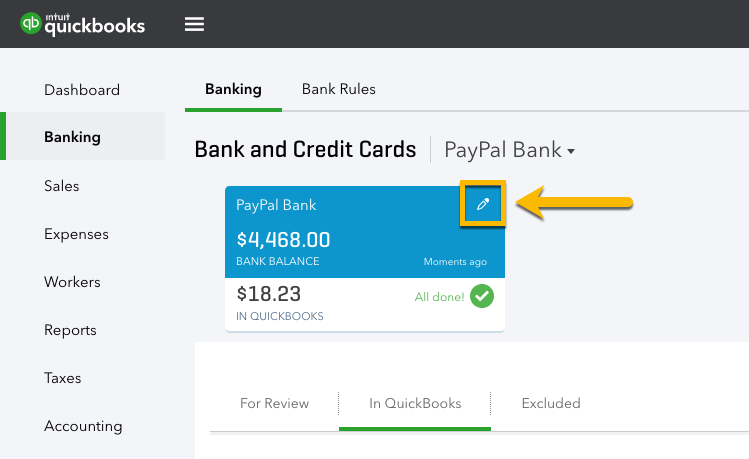

- Click on the PayPal Bank where you will get your PayPal transactions, then Next.

- Choose the sales tax rate which will apply to all imported transactions of sales, then hit Next.

- In case you have previous transactions, filter the data you have to begin importing from, then click Done.

Add Paypal Account In QuickBooks Online

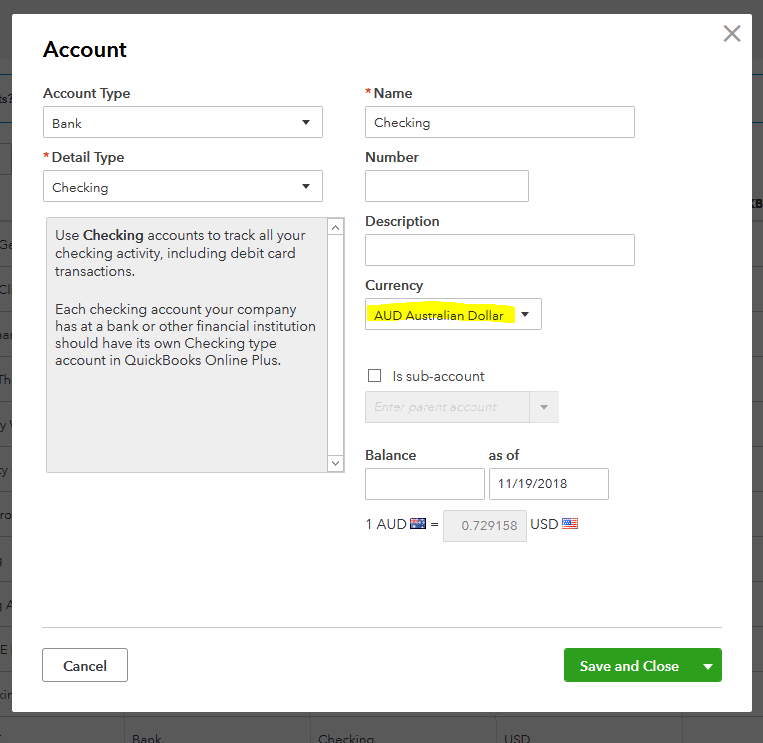

If you allow balance money within the account as a result. Then you wish to possess this cash plus listed on your record. To boot as you transfer funds into and out of your PayPal account. After that from your bank account, you’d want the PayPal account entered in QuickBooks Online to properly record the transfer.

Transfers may well be transfers that you just in person initialized. They might be transfers initiated mechanically by PayPal to hide purchases with funds from your bank account. Then your PayPal balance can simply too low.

If you merely use PayPal as a digital billfold, as a way to store your MasterCard data. Therefore, looking for merchandise websites is quicker, then you’ll depart without connecting PayPal to your QBO account. The expense related to no matter. Because you bought it is recorded inside the MasterCard account, which positively ought to be connected to QuickBooks.

Other Options To Record PayPal Fees

With this technique, first, you’d receive payment on Associate in Nursing invoice and deposit it to undeposited funds. Then you’d move to the fast produce menu +NEW and choose a deposit. Before saving the deposit screen, wherever it states Add funds to the current deposit. Then accounting associate in the nursing account and enter a negative range. But they regulate down the whole deposit quantity. like as the sales receipt technique. This creates the whole quantity of your deposit up to the net quantity of the group action. However, it can still record the complete quantity of the customer’s payment.

How To Enter PayPal Transactions Manually

It negates the necessity for knowledge entry. This not solely saves time however prevents typos, the prospect of duplicate transactions, and also the likelihood of missing transactions.

QuickBooks associate degreed PayPal unrolled an app referred to as connect with PayPal. But to exchange the synchronization with the PayPal applications. Paypal works just like the Bank Feed for a bank account. It pulls in knowledge from PayPal mechanically, together with detail of the gross and fee amounts. It pushes associate degree expense group action into Undeposited Funds that gets deposited with the financial gain group action. This app accomplishes the goal we have been discussing to possess the whole quantity of your deposit. Such as adequate Infobahn quantity of the group action. However, it still has a total quantity of the customer’s payment recorded.

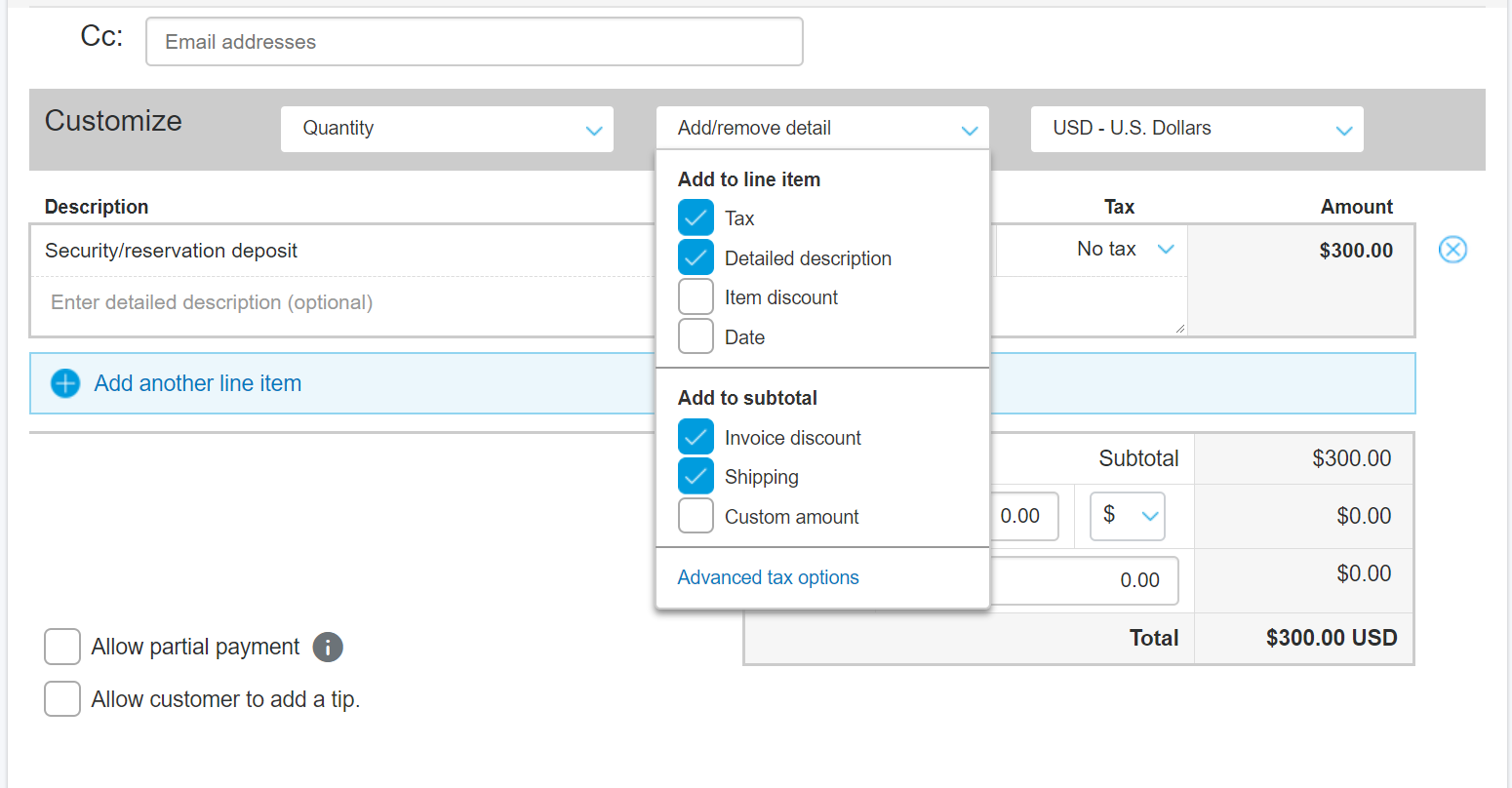

In the app settings, you’ll customize what accounts the app mechanically posts the financial gain and also the fee too. I want you’ll assign the financial gain account on the fly from the bank feed. However, you have got to click details and look forward to the group action to require the total screen. Still, this app may be a time-saver if you have got serious PayPal assets volume.

How to Record Amount Customers Transactions

If you are exploiting sales receipts to record your financial gain. You will be able to produce your sales receipts with 2 lines. The primary line would be up to the overall financial gain you attained or the overall donation you received. The second line would be recorded as a negative range and would be up to PayPal’s fee. This may build the overall quantity of your sales receipt up to the internet quantity of the group action. However, it can still record the total quantity of the customer’s payment.

Conclusion

If your PayPal procedures don’t mirror the on top of best practices. Then you take help from your QuickBooks accountant services and set it up for future success. We hope this blog is helpful to you if you have got the other PayPal queries then you hire a QuickBooks ProAdvisor for an instant solution.