Last Updated on December 15, 2020 by

Intuit ProSeries is a comprehensive answer for charge preparers hoping to record their profits flawlessly. This duty QuickBooks programming is exceptionally favored by its clients of the convenience. ProSeries is now accessible on two different product levels that are Basic and Professional levels. In which the ProSeries Basic fulfills the needs of entry-level professionals who normally process easy tax returns, Tax Preparation ProSeries Professional is bent for the high volume accounting works and covers a wide area of return types. ProSeries Basic is a section level programming utilized for documenting singular returns. Clients have the choice to look over three existing bundles according to their necessities.

- 1040 Package

- Pay-Per-Return

- Boundless Returns

Intuit ProSeries helps experts and individual expense preparers by giving propelled highlights to a superior assessment documenting the experience.

Strengths Of The Product

- Very simple interface providing data entry easily on tax forms.

- Collaboration features with QuickBooks and TurboTax

- Feature to import scanned data easily, though at a separate

- Low-cost point is beneficial for small to mid-sized businesses

- Provide on-premise and cloud-based access

Potential Weaknesses Of The Product

- Low review tools in place

- Complexity for remote access

- Firm returns are available for an expensive plan

Features

Here are some highlights of Intuit ProSeries.

Information Input Assistance

Intuit ProSeries offers powerful devices that help charge preparers to fill the subtleties in the tax documents. The assistance devices gave by the product include.

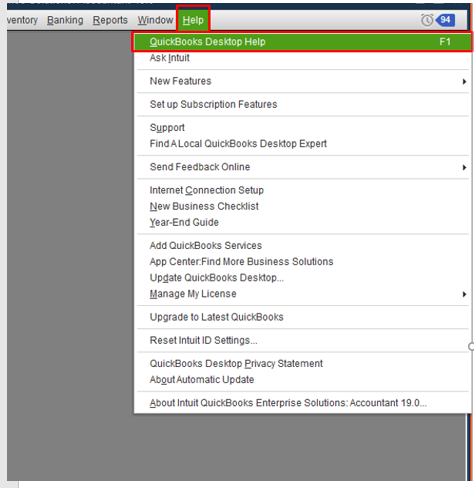

- On-screen Help- It permits to clients acquire data. From the online knowledgebase that chipping away at the arrival.

- Line-delicate Help is utilized to follow the source record for any field information and assists with making sense of the data required for a specific field.

- Where Do I Enter is utilized to find the correct structure and field in Federal 1040, 1065, 1120, and 1120s items.

These highlights help make the e-recording process quicker and simple to-utilize.

Broad Form Library

This ProSeries program gives 3700 structures and calendars. That’s including 1040, 1041, 1120, the 1120S, 706, 709, 990, and more to address the issue of organizations. ProSeries offers support for a boundless number of 1040, individual, government and state, and blessing returns. Experts can import K-1 business information to the individual returns without any problem. It spares time spent on manual passage work and improves proficiency.

Customer Management Solutions

ProSeries offers the fabricate apparatuses. Like customer status, and missing information. The e-recording affirmations can be recovered or downloaded physically inside the assessment programming utilizing e-document declarations. Customer Status arrangement assists with keeping a beware of the advancement of customer returns and making reports or an agenda for the equivalent. This empowers us to monitor void fields. The status of the missing information is followed, and a mechanized solicitation is sent to the specific customer through a tweaked email.

Mistake Check

Intuit ProSeries covers 1,000 mistake checking diagnostics. It gives a broad blunder check to a precise assessment documenting the process. ProSeries Professional variant has an in-constructed highlight of Forms Bar, which is utilized for finding blunders and fixing them in any assessment form. It managing the clients to the necessary tax document and enters the information.

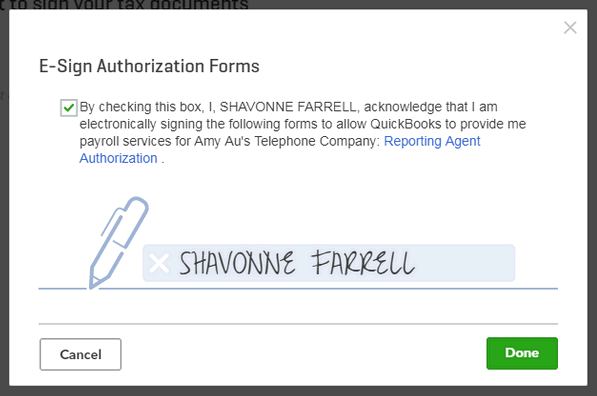

E-Signature

E-Signature offered by DocuSign is an advantageous method to sign critical records, structures, and records carefully in an IRS-endorsed way. However, it is bringing straightforward information into important structures. But the customer organizer contains are short. That assists with serving the customers in a superior manner. From the assessment year 2019, eSignature has included. Another element of the robotize dashboard. That conceals to eight statuses for following and updates, which include:

- Declined

- Conveyed

- Verification Failed

- Various

- Marked

- Incompletely Signed

- Voided

- Lapsed

Intuit Link

Intuit Link assists with streamlining the way toward get-together data from customers by offering an online entry. It is a helpful and secure stage that empowers experts and clients to share significant information. The Intuit link offers efficient devices. Like robotized updates, custom email layouts, report solicitations, and that’s only the tip of the iceberg. Experts can monitor the advance and tell customers if there should arise an occurrence of any necessary data or record. Intuit Link assists with documenting assessment forms quicker and arrange information without any problem.

Assessment Planner

Assessment Planner is an in-fabricate component in ProSeries charge programming use to evaluate charge installments for 1040 return of the present year and past. It is available under government expense forms. For the Professional and Basic variants. Duty Planner gives two significant worksheets. That can be fill by the expense preparer for better arranging of the procedure.

- Duty Planner Summary Information Sheet

- Duty Planner Taxpayer Information Sheet

Synopsis information Sheet helps keep the record. Like duty year, plan portrayal, swelling rate. The Citizen Information Sheet holds the data about citizens recording subtleties, and the compensation and pay data.

Mix Capability

Intuit ProSeries can incorporate with outsider additional items for included usefulness. It helps experts to develop their training by expanding the estimation of their administrations. Probably the most supportive incorporations with ProSeries charge programming are

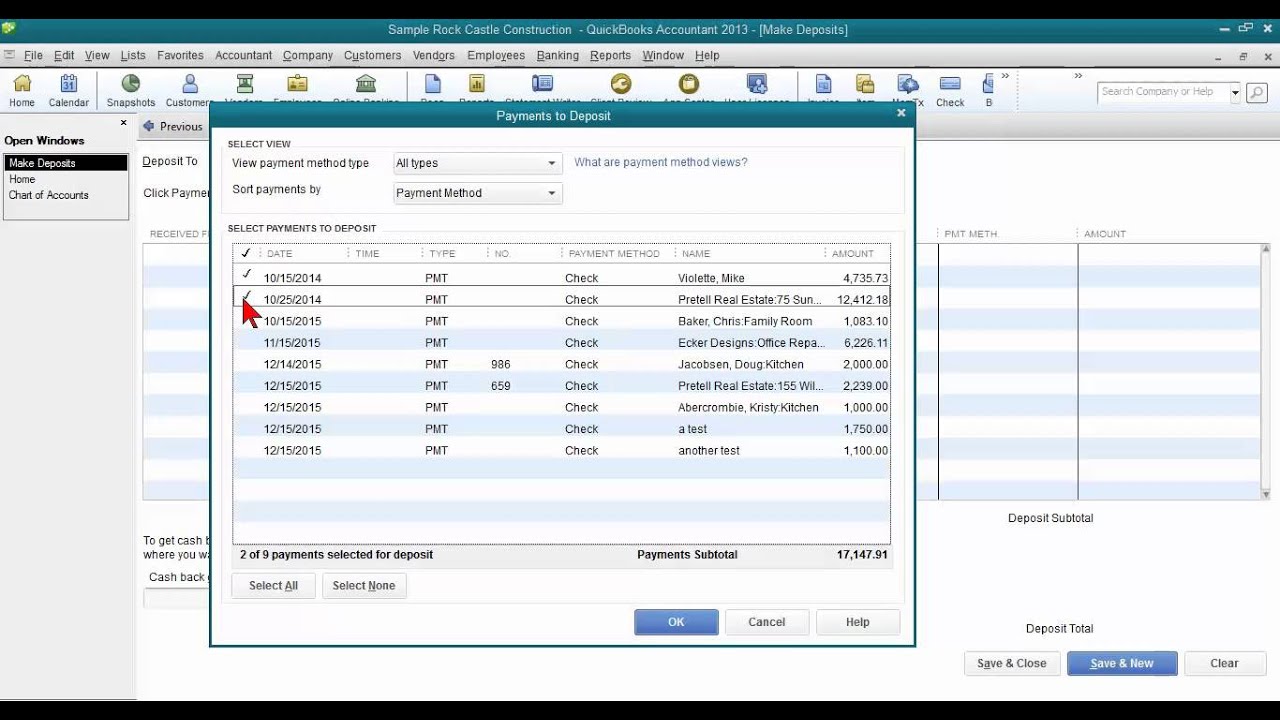

QuickBooks: Imports bookkeeping information legitimately into the ProSeries charge programming.

- Pay-by-Refund– Collects charges from customers through their discounts advantageously.

- SmartVault– Manages archives and offers customer entry for secure sharing of documents.

- Fixed Asset Manager– Imports resources legitimately into Schedule E and Schedule C.

- E-FileCabinet– Automates the information stockpiling and association process.

These mixes permit charge preparers to accomplish more in less time.

ProSeries Client Organizer

Customer Organizer is accessible for ProSeries Professional form. It helps in orchestrating the necessary data from customers for various structures and returns as-

- W-2 pay

- Capital increases

- Discount affidavit

- Vehicle and truck costs

It computerizes the greater part of the information passagework. It is bringing straightforward information into important structures. The customer organizer contains short forms for customers. With the similar less difficult returns.

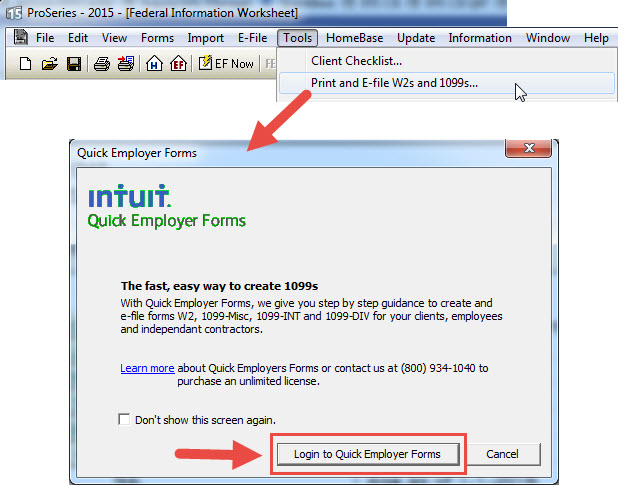

Fast Employer Forms Accountant

Fast Employer Forms Accountant is available straightforwardly from Intuit ProSeries programming. It gives step-to-step direction on documenting structures, including 1099s 1099-MISC, 1099-INT, and 1099-DIV and W-2.

- Intuit QuickBooks Employer Forms Accountant e-documents the important structures in three simple advances:

- Straightforward inquiries are curated for customers to reply to pick the correct structure.

- Customers’ survey shape is equivalent.

- E-Filing is complete and frames are send to the IRS.

Conclusion

Intuit ProSeries charge programming has plenty of highlights that give true serenity to the duty preparers. It’s easy to use a structure-based interface that makes it simple -to-utilize programming. Intuit ProSeries programming with the intensity of cloud innovation gives stockpiling adaptability according to the need. The groups’ coordinate effort on a solitary stage and anyplace access to the expense information.