Last Updated on February 3, 2021 by

Under the CARES act which stands for Coronavirus Aid, Relief, and Economic Security Act, you can defer a portion of Social Security tax payments and your Payroll will be helping you in tracking that amount. But you should be known that you are responsible for remitting payments to the IRS on the new 2021 and 2022 dues dates. You can also set you a reminder that will be notifying you that when the new payment dates are coming.

So, here learn about the method for tracking deferral payments for the social security tax payments in QuickBooks.

Steps for Explaining the Working of CARES Act Tax Deferral

You should first know the working of the CARES Act Tax deferral. They are discussed below:

- The employee who is eligible can defer the payment of the employer share for the social security taxes which are accrued from March 27, 2020, till December 31, 2020. ( Here December 31, 2020, is also included).

- In this, the payments include 6.2% of all the wages which is up to the social security beam.

- Even 50% of the deferred social security taxes left pending till December 31, 2021, with a remainder due till December 31, 2022.

- Here the deferral of the social security taxes is not available for those taxes which are due for the deposit after you are receiving debt forgiveness under the paycheck protection program.

But yeah you should know that as the employer you are responsible for tracking and also submitting the deferred payments.

You are having any doubts or want to know more about the CARES act or deferring the employer portion of social security then you can contact your accountant or accounting professionals.

Here your steps depend upon the product in QuickBooks used by you.

So, first, you need to see that which is the Payroll product that you are using.

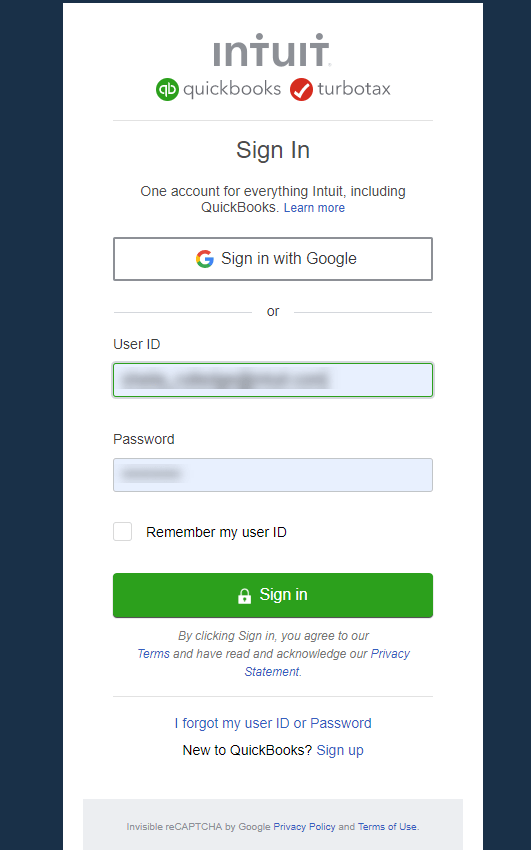

- If you sign in and your screen looks like this then it confirms that use QuickBooks Online Payroll.

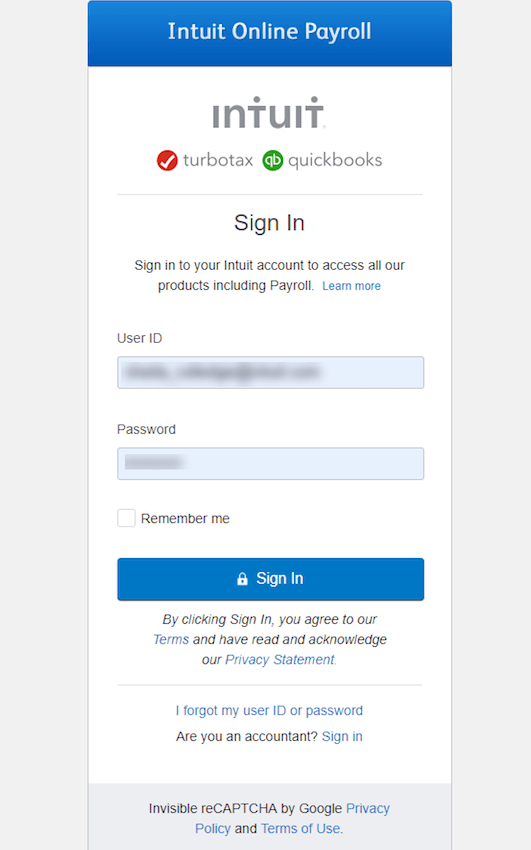

- But if you sign in and your screen looks like this then it confirms that you are using Intuit Online Payroll.

Procedure for Setting Up the Payroll For Tracking Deferrals in QuickBooks

For setting up the Payroll for tracking deferrals social security tax payments by selecting your QuickBooks products:

Steps for Tracking Deferrals in QuickBooks Online Payroll (Core, Premium, and Elite)

For tracking the deferrals social security tax payments in QuickBooks Online Payroll (Core, Premium, and Elite) you have to follow the steps which are discussed below:-

- Firstly, you need to go to the settings and then you have to click on the Payroll settings.

- In this step, you have to go to the CARES Act sections. And then from it, you have to click on the employer social security deferral link.

- At last, you have a checkbox which is present next to I want to defer my employer portion of social security. And then you have to finally click on ok.

Steps for Tracking Deferrals in Intuit Online Payroll

For tracking the deferrals social security tax payments in Intuit Online Payroll you have to follow the steps discussed below:-

- Firstly, you need to go to the setup option.

- In this step, you have to go to the CARES Act sections. And then from it, you have to click on the employer social security deferral link.

- At last, you have a checkbox which is present next to I want to defer my employer portion of social security and then you have to finally click on ok.

Steps for Tracking Deferrals in Intuit Online Payroll Full Service

For tracking the deferrals social security tax payments in Intuit Online Payroll Full Service you have to follow the steps discussed below:-

- Firstly, you have to go to the account settings option.

- In this step, you have to go to the CARES Act sections. And then from it, you have to click on the edit option which is present next to the employer social security deferral.

- And at last, you have a checkbox which is present next to I want to defer my employer portion of social security and then you have to finally click on ok.

Steps for Tracking Deferrals in QuickBooks Desktop Payroll

For tracking the deferrals social security tax payments in QuickBooks Desktop you have to follow the steps discussed below:-

Step 1- Steps for Setting up the Payroll items for Tracking the Deferral SS Tax Payment

Here are the steps for setting up the Payroll items for tracking the deferral social security tax payments in QuickBooks Desktop Payroll are:

- First, you have to go to the employee menu and then you have to go to the manage Payroll item option and then select the new Payroll items.

- In this step, you have to open the Payroll item type window and then you have to select the other taxes and select next.

- After this, you have to go to the other tax window and then you have to select CARES co. soc. Sec. deferral and now you have to click on next.

- Now, you have to go to the agency for the company-paid liabilities window. And then from there, you have to click on the agency to which you are paying taxes from the drop-down menu.

- Then in this step, you have to click on the Payroll liabilities from the liability account which is present in the dropdown menu. Then you have to click on the Payroll Expenses from the expense account also present in the dropdown menu and then click on the next option.

- At last, you have to go to the taxable compensation window and from there you have to click on the finish option.

But if you are having the QuickBooks Desktop Payroll Assisted then at that time you need to contact QuickBooks for activating the deferral credit in and then follow the steps which are discussed above.

Step 2- Steps to Create a Check to Pay the Payroll Liabilities

When you have set up the Payroll items for tracking deferral social security tax payments in QuickBooks Desktop Payroll, now you have to create a check to pay the Payroll liabilities:

- Firstly, you have to go to the employee menu and then from there, you have to select Payroll center.

- Then you have to click on the pay liabilities option.

- In this step, you have to go to the pay taxes and other liabilities section. Then you have to mark the federal 941 and you have to be sure for the check amount and the item list under the Payroll liabilities should be accurate. Now you have to click on view/ pay.

- After this, you have to go to the Payroll liabilities option. Then you have to go to the Payroll item which is present in the drop-down list. And in that enters the CARES co. soc. Sec. deferral and the amount of the 941 tax liabilities you quantify for. Then you have to enter the amount as a negative amount and then click on recalculate for adjusting the liability.

- Now you have to click on to be printed if you want to print the check. But if you are using a handwritten check you have to enter the check number or other references in the NO. field. But if you are paying liabilities by electronic funds transfer (EFT), and clear to be printed checkbox and then enter the EFT in the NO. the ground of the liability check.

- In this step, you have to click on the save and next or save and close option.

- Then you will able to see your Payroll liabilities payment summary. Then you can review the payments which you have scheduled and print a copy of the summary. And click checks.

- At last, you have to re-run the Quickreport for watching the difference in the liabilities credit which you are still able to claim if your credit was larger than your liabilities.

But for assisted Payroll subscription you have to social security employer deferral request after the first paychecks in quarter 2 and will be starting on the date of request. It will not be retroactively deferred.

Winding Up

This article will help you to track your deferral payments for social security tax payments. But if in case you face any issue then you can contact QuickBooks ProAdvisor and can get the best solution to your problem.